Welcome back to another monthly dividend report! We are now one-third of the way through 2021, and the dividend results for my Portfolio are looking good.

On a bright note, a couple of things got back to normal for my Portfolio in April. First, all my expected dividend payments for April were actually paid in April. I didn’t have any that were pulled into March or delayed until May. Second, I was able to reinvest all my dividends in April after couple of months where I wasn’t able to do that due to an account switch I made at my brokerage.

So, all my ducks were in a row, so to speak, and that made me happy. 🙂

You’ll see I notched some solid dividend totals this month on the back of some good YoY growth. Not all months turn out this way, but it pleases me when it does.

My Portfolio has started a stretch of the year where dividend raises won’t be as plentiful as in prior months. However, I did have a pair of my legacy stocks deliver raises in April. Given that these stocks are some of my biggest dividend payers, the raises led to a nice boost in additional forward dividend income… always a welcomed occurrence.

Trading wasn’t light or heavy in April. I had a couple of trading days during the month where a made a handful of moves. All the trades only resulted in a net investment of about $400, so it was basically a reallocation of funds. One stock exited my Portfolio, and another one arrived, as a result of the trades. I’ll share those two stocks a bit later.

As for additional forward dividend income, it a was terrific month. I recorded nice gains from all categories: reinvested dividends, dividend raises and new capital investment. April was the first month where 2021 monthly totals were better than those from 2020. This seems a bit strange given the setbacks we encountered in 2020 due to the pandemic, so it should be interesting when we look at the numbers a little later.

Anyway, let’s get to the dividend income, and all the other dividend-related items from April…

Dividend Income

My Portfolio collected a hefty total of $862.35 in dividends in April. One notable achievement this month… I had my first triple-digit payer for the month of April. Thank you Altria Group (MO)!

YoY growth came in at 16.48%, when comparing this April’s dividend total to the $740.31 from April 2020. This was my best YoY growth percentage of 2021 thus far, and it bested my monthly target goal of 15% YoY growth.

A total of 19 companies paid me a dividend this April. While I don’t have lots of huge dividend payers this month, I raked in over $25 from 16 of the 19 stocks. Not a bad haul!

MO was my top dividend payer in April with that triple-digit payment. It came in at $101.93 and it looks poised to continue growing due to reinvesting the dividends of this high-yielder. In addition, I suspect that by this time next year RPM International (RPM) will join that triple-digit dividend payer club for me, too. I look forward to that day!

Sysco (SYY) posted my smallest dividend payment of the month at $11.59. I’m pretty certain that won’t be the case next year. Find out why coming up.

The increased dividend amounts from Automatic Data Processing (ADP), Cisco Systems (CSCO), Comcast (CMCSA), and Realty Income (O) were helped by additional purchases over the past year. Increased amounts for the other companies were a result of dividend increases and reinvested dividends over the past year. The YoY dividend gain from MO was over $10, and all organic (combination of dividend raises and dividend reinvestment). Solid organic boosts of close to $6 were achieved by RPM and Illinois Tool Works (ITW) as well.

I had a pair of dividend payout reductions in April. The reductions were recorded by Gentex (GNTX) and Air Lease (AL). Both were the result of recent trims that I made. In both cases I reallocated the sale proceeds into higher yielding stocks, which provided a boost to my forward dividend income.

April saw my Portfolio deliver two new dividend payers: Merck & Co (MRK) and OGE Energy (OGE). MRK debuted in the top half of my April dividend payers… an impressive start. I’ve been adding to my MRK position rather aggressively in 2021, and this is the result of those efforts. OGE started farther down the list, but I recently enhanced my position in this stock, so expect OGE to move impressively up the dividend payer list next quarter.

I can happily report that I didn’t have any dividend payers disappear this April compared to last year. In other words, all the dividend payers from last April continued to ring my dividend register this April. With no missing dividend payments to overcome, it was relatively easy to achieve some good YoY growth.

As noted earlier, for the first time in 3 months, all my dividends got automatically reinvested into the stocks that paid them. The dividend re-investments are occurring like clockwork in my Portfolio once again! Hallelujah! The resulting additional forward dividend income boost came in at $28.38. This was better than the monthly $25 target I have.

Thanks to all the reinvested dividends from April, I purchased over 12.4 shares of stock. This included over 2 shares of MO, and better than 1 share of GNTX. I came up just shy of 1 share with RPM and Iron Mountain (IRM).

Dividend Raises

The quantity of dividend raises for my Portfolio in April was noticeably low. However, this wasn’t unexpected.

I only had a couple of companies slated to announce a raise this month, and that’s what I got.

Once again, my first raise of the month was my best one. I received a 10% dividend increase from Procter & Gamble (PG). This was a 2x improvement from the average they’ve been posting in recent years, so I was stoked about that.

The other dividend raise announcement came from Johnson & Johnson (JNJ). JNJ has consistently delivered 5%-7% raises for the last decade, and they came quite close to being in that range again. Unfortunately, they missed by just a bit with their 4.95% boost.

As previously mentioned, these legacy stocks of mine are some of my best dividend payers, so even though I only had 2 raises in April, they delivered more in additional forward dividend income than the 4 raises I saw in March.

This pair of dividend raises increased my forward dividend income by a solid $60.72. Both stocks contributed nicely to this total, but PG did the heavy lifting in this case.

I’d have to invest $2,663.16 at my Portfolio’s current average yield of 2.28% in order to receive the same boost to my forward dividend income as this month’s raises.

It appears that the month of May will be light on dividend raises in my Portfolio as well. At most I’m on the lookout for raises from Main Street Capital (MAIN), and Lowe’s Companies (LOW). Spoiler alert… MAIN declared their dividends and they didn’t include a raise, so there goes one of my chances for a boost. Let’s hope LOW can salvage the month of May for me and help me avoid getting shutout.

Dividends Due To New Investment

In the month of April I made 5 stock trades involving 4 different stocks.

To start, I trimmed my W.P. Carey (WPC) position and used those proceeds to establish a position in OGE Energy (OGE). I also invested a bit of cash to expand my Merck & Co. (MRK) holdings.

Here are the details for those moves…

Recent Transactions – WPC, OGE, MRK

Later in the month, I sold off my entire Sysco (SYY) position and used those sale proceeds to solidify my OGE position.

The details for these transactions can be found in this post…

Recent Transactions – SYY & OGE

All totaled, I made 2 sales and 3 purchases (2 of the buys were of the same stock).

After accounting for all the transactions, it was a net investment of $399.30, and a boost to my forward dividend income of $64.50.

The big income increase relative to the cash invested was the result of my stock purchase of OGE having a much better yield compared to my stock sale of SYY. It was a strategic stock swap to help boost my Portfolio’s dividend income while better aligning my sector weightings with my targets.

With SYY departing from my Portfolio, but OGE arriving, the number of stocks in my Portfolio held steady at 52.

Tallying Up The Additional Forward Dividend Income

In 2021, I’ll continue tracking my additional forward dividend income generated each month from the trifecta of sources: reinvested dividends, dividend raises, and new capital investment.

I show 2020’s totals, too, so that we can compare as the year progresses. I’m optimistic that I can do better in 2021 after some unexpected dividend setbacks in 2020.

I posted some strong additions to my forward dividend income this April. For the first time this year, I was able to surpass the monthly total from a year ago. I suspect that will be the case for each of the next four months, too, as last year, starting in May, I tallied a lot of negative numbers which subsequently dented my year-end totals. I’m feeling optimistic that won’t be the case in 2021.

As you can see, my year-to-date totals from Dividend Raises and Investment of Capital are already approaching my totals from all of 2020 in those same categories. 2021 is shaping up nicely assuming we can stay on track.

For the 2nd month in a row, Investment of Capital provided the biggest boost to my additional forward dividend income (just barely this time). This wasn’t the result of a lot of investment, but rather a strategic stock swap where I switched out a lower-yielding stock with a higher-yielding one.

Also, I continued this year’s streak of each month’s additional forward dividend income due to Dividend Raises being better than the previous year. That’s 4 months and counting, with easy comparisons for the next few months suggesting that I can extend that streak.

Finally, I think it’s clear already that I will come up short of beating last year’s Reinvested Dividends total. This is mainly due to rising stock prices over the past year translating into fewer shares in DRiP. However, those few dividend payments that didn’t get reinvested over the past couple of months didn’t help the cause either.

Progress Charts

The following are progress charts, also available on my Dividends page. It was another good month… steady as she goes!

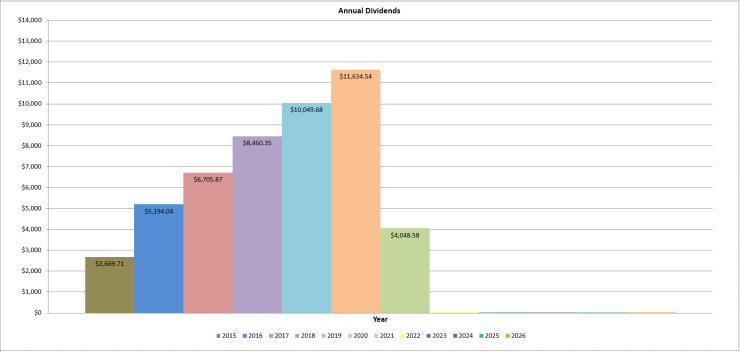

On an annual basis, here’s what the dividend totals look like. One-third of the year complete and I’m on pace to surpass last year’s dividend total. Stick with the plan and it should all work out.

Summary

My Portfolio wrapped up another solid month with regard to dividends.

I collected over $862 in dividends from 19 dividend payers. I notched my first-ever triple-digit payer for the month of April, too.

YoY dividend growth nearly touched 16.5% in April, my best month of 2021 thus far.

I was able to reinvest all my dividends in April for the first time since January. This led to over $28 of additional forward dividend income.

Only 2 dividend raises came my way in April, but the one from PG really made my month. Their 10% boost was their best in years. The two April raises resulted in nearly $61 of additional forward dividend income for my Portfolio.

Transaction activity finished with a typical amount – 5 for the month. One of the transactions led to a stock exiting my Portfolio (SYY), while another led to a new holding being established (OGE). These transactions resulted in a net investment over $399 and a forward dividend income increase of $64.50.

Adding up the contributions from all categories in April, I had nearly $154 in additional forward dividend income drop into my Portfolio. This brings my current annual forward dividend income total to $12,809.15.

How did April treat your Portfolio? Did you rake in some sweet dividend totals? Did you record some impressive YoY growth? Please let me know in the Comments!

I have updated the Portfolio & Dividends pages in conjunction with this monthly update.

Congrats an an awesome April ED! We both benefited nicely from the PG and JNJ increases. Always glad to see your impressive progress. Keep it up! 🙂

Thanks, MDD. It was a good April. A few more dividend raises would have been nice, but I’ll take what I can get. That 10% from PG was superb given the smaller raises from PG over the past few years.

In May, I’m hoping to avoid being shutout with regard to dividend raises. Unfortunately, my Portfolio is not strong when it comes to dividend raises in the spring & summer.

Looks like another excellent month, Engineering Dividends! Congrats on the YoY growth rate and hitting triple digits with MO. I’m holding MO too. Do you have any concerns over the nicotine regulation? I am planning to keep holding, but I am just wondering if you have any thoughts on that. Thanks for sharing your recent transactions and nice-looking charts. Great write-up as always. As for my dividend income, I didn’t hit a record but I did post solid YoY growth. I expect to hit a new all-time record in June.

Hey Graham. Thanks! I’m very happy with my April results.

Oh yeah, I’ve got plenty of concerns with regard MO. So much negative news around this company, but they seem to manage through it.

I assume the nicotine regulation you were referring to was related to the possibility of having to lower the nicotine level to a non-additive point?

Hard to get too worried about that until it actually becomes a requirement.

Of course there’s also the FDA plan to ban menthol cigarettes, the big write-off of the Juul investment, and Biden wanting to raise excise taxes on cigarettes. I’m sure I probably left out other headwinds as well.

Even though MO isn’t one of my largest Portfolio positions, it is near the top from a dividend weighting perspective thanks to their huge yield.

This is why I’m not adding new capital to my MO position at this point (however, I am reinvesting my dividends). With such a big yield my MO position seems to grow just fine through dividend reinvestment alone.

Thanks for sharing your thoughts on MO, ED. They seem to manage through the headwinds quite well. They even managed to raise the dividend last year. My strategy is the same as yours. I am not adding to it anymore, I’m just holding and reinvesting the dividends.

Awesome results ED! We don’t share that many companies this months but we did share those two increases! Even though there small positions for me (which I intend to remedy in the future), every little bit helps!

Keep up the great work my friend!

Thank you, Mr. Robot. I enjoyed this month’s results, no doubt. Glad to hear you got to share in my only two dividend raises in April.

I’m always looking for new candidates for my Portfolio. Sounds like you have a few I don’t, so I may have to check out your portfolio again for some ideas.

What a month, what a month, what a month ED! Fantastic dividend sum and a HUGE dividend from Altria Group. I’m all smiles here as I read your dividend income summary. What’s not to love?!

Bert

It was a good month of April, Bert. However, since you asked, I could have used a few more dividend raises! 🙂

The snowball keeps growing, slowly but surely.